How I turned a pile of idle cash into a focused growth portfolio aimed at 20% annual returns.

This week I finally stopped thinking about fixing my portfolio and actually did it. After years of random buys, half-hearted holds, and a lot of “it’ll probably go up,” I decided to get serious and rebuild everything from the ground up.

If you’ve been sitting on a pile of cash or a messy mix of funds wondering where to start, this post should help. I’ll walk through how I approached my portfolio overhaul, what tools I used for analysis, and the exact framework I followed to buy new stocks.

Affiliate Disclosure: I used StockAnalysis Pro for all screening and valuation data. It’s clean, fast, and actually fun to use. If you use my link, it helps support this project — no extra cost to you.

Why I Restructured

After holding a mix of solid names and impulse buys for way too long, I finally sold off a big chunk of my portfolio that didn’t fit my long-term goals. Things like CMG, LULU, AMZN, and extra SPY shares were fine companies, but they didn’t serve the strategy I’m trying to build toward.

Once I sold those positions, I freed up about $60,000 in cash. That gave me a clean slate and the chance to actually build the kind of portfolio that could hit my goal: 20 percent annual returns over the next several years.

The idea wasn’t to get “safer.” It was to get smarter and focused, deliberate, and built around businesses that have both strong fundamentals and durable long-term trends behind them.

Here’s what my portfolio looked like after freeing up that cash and cleaning house:

- Equities: 43 percent

- Cash: 57 percent

Breakdown:

- SPY – $42,320

- NVDA – $545

- DDOG – $782

- NFLX – $1,113

- SHOP – $1,169

- Cash – $61,816

Basically, I was sitting on a lot of dry powder. The goal was to put that cash to work, not recklessly, but intentionally into sectors with real growth drivers and pricing power.

My New Portfolio Structure (and How It Helps Me Reach 20%)

I rebuilt my portfolio to balance conviction with diversification. The goal is simple: hit 20 percent annualized returns by leaning into innovation while managing downside risk.

| Category | Target % | Rationale |

|---|---|---|

| Core AI + Semiconductors | 25% | Picks and shovels of the AI gold rush (NVDA, AVGO, SMCI, TSM) |

| Software / Cloud / Cybersecurity | 20% | Recurring-revenue compounders (DDOG, CRWD, NOW) |

| E-commerce / Fintech | 15% | Balanced growth (MELI, SHOP) |

| Index ETF anchor | 15% | SPY or QQQ for steady exposure |

| Energy / Infrastructure / Hard assets | 10% | Inflation hedge and real-world stability (SLB, XOM, CCJ) |

| International Growth | 5% | Optional India ETF (INDA) or additional MELI exposure |

| Cash / T-Bills | 10% | Liquidity for pullbacks or quick entries |

This structure gives me multiple paths to growth.

AI and semiconductors drive the biggest upside. Software and fintech offer scalable, recurring revenue. Energy and infrastructure hedge inflation and add balance. The cash buffer gives flexibility for new opportunities without ever being forced to sell at a bad time.

It’s not about predicting the next big winner, it’s about creating a system where multiple things can win at once.

Core AI + Semiconductors: The Conviction Bet

AI may feel like the party everyone already showed up to, but I still think we’re early.

We’re just scratching the surface of AI-generated entertainment, AI-driven shopping, and yes, AI companionships. Whether that excites or terrifies you doesn’t matter. It’s happening.

That’s why I’m allocating 25 percent to Core AI and Semiconductors. These are the companies building the infrastructure that everything else runs on.

My shortlist: NVDA, AVGO, TSM, and ANET.

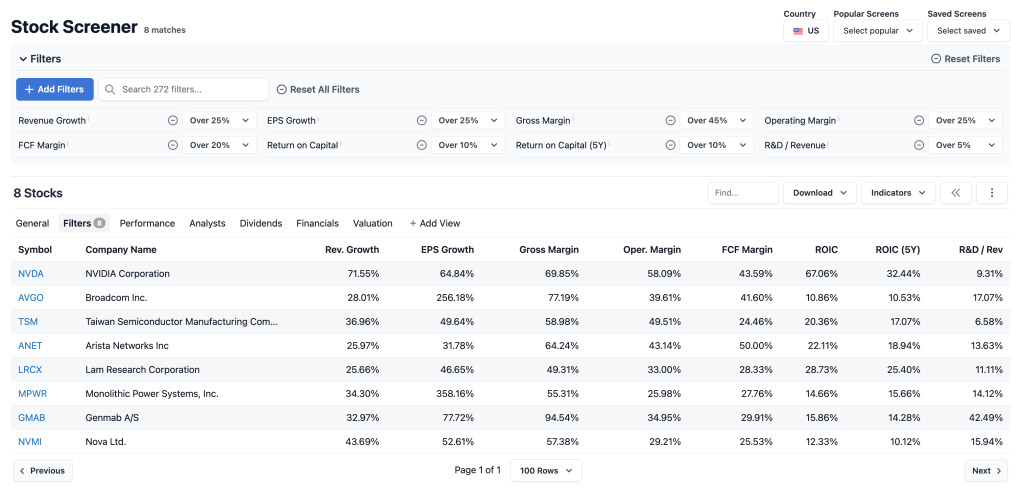

The Fundamental Screen

To avoid buying hype, I built a simple but strict checklist using StockAnalysis Pro.

Each stock had to meet at least 7 out of these 9 targets:

| Metric | Target (Buy Zone) | Why It Matters |

|---|---|---|

| Revenue Growth (YoY) | ≥ 25% (high-growth) | Confirms strong demand |

| EPS Growth (YoY) | ≥ 25% | Shows margin leverage |

| Gross Margin | ≥ 60% (design) / ≥ 45% (manufacturing) | Pricing power |

| Operating Margin | ≥ 25% | Efficiency and scale |

| Free Cash Flow Margin | ≥ 20% | Real cash generation |

| ROIC | ≥ 10% | Capital efficiency |

| Guidance Trend | Raised or reiterated higher | Confirms management credibility |

| Debt-to-Equity | < 0.5 | Financial safety |

| R&D Intensity | ≥ 5% | Continuous innovation |

If a company hit 7 or more of these, it passed.

NVDA, TSM, and AVGO all passed easily. ANET looks strong but I’m waiting for earnings to confirm.

My Actual Plan

| Stock | Target | Initial Buy | Logic | Stop |

|---|---|---|---|---|

| NVDA | $5K | $2.5K now | Trend intact, strong fundamentals | ~10% below entry |

| ANET | $5K | $2.5K now | Test position before earnings | ~10% below entry |

| TSM | $5K | $2.5K now | Add if semis confirm | ~10% below entry |

| AVGO | $5K | $2.5K now | Wait until after NVDA earnings | ~10% below entry |

I’m also trimming SPY to 15 percent of the portfolio and rotating out of funds that haven’t outperformed the market in years. If it can’t beat SPY, it’s dead weight.

Going Forward

- Reevaluate monthly and compare performance to SPY or QQQ

- Rotate out of any laggard that underperforms by more than 10 percent

- Keep expanding exposure into software, e-commerce, and infrastructure

- Maintain 10 percent cash for optionality and sanity

The goal is to stay flexible. Markets change fast, and I want a system that can evolve without panic.

Final Thoughts

This restructure wasn’t about chasing hype or trying to double my money overnight. It was about building a disciplined framework to consistently hit my 20 percent annual goal.

If you’re trying to do the same, define what success looks like for you, filter out what doesn’t serve that goal, and build around sectors with real staying power.

If you want to use the same screening tool I used, check out StockAnalysis Pro. It made the entire process way easier and gave me confidence in the numbers I was looking at.

Now it’s time to let the AI miners do their thing and hope my stop losses don’t get hit before the next earnings season.

Leave a comment